What is bookkeeping?

January, 2024 · 4 min read

Among many obligations as a business owner, you must pay taxes. Any profits you make are taxed, and taxes are involved whenever you pay salaries. There’s also something called value-added tax (VAT). To keep track of all these things, one must bookkeep. What does bookkeeping involve? We’ll also look at the role of accounting firms and software solutions.

Ledger – a log of all transactions

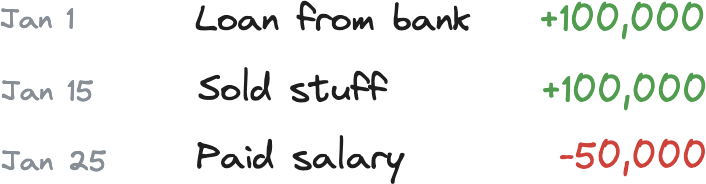

A fundamental aspect of bookkeeping is maintaining a ledger. Whether we run a company or not, we’re all familiar with logging into our bank account to see a list of all transactions. Ledgers are similar, where each entry contains an amount, a date, and a textual description. In addition, many entries often have a document, such as a receipt or an invoice, accompanying it.

However, having these fields alone isn’t specific enough. Loaning 100,000 would otherwise appear the same as selling something for 100,000. Because of this, you also need to categorize entries in some way beyond their textual description.

Double-entry bookkeeping, credits and debits, accounts

Understandably, letting every company create entries however they like would get extremely messy. Hence, we follow conventions – most companies use double-entry bookkeeping.

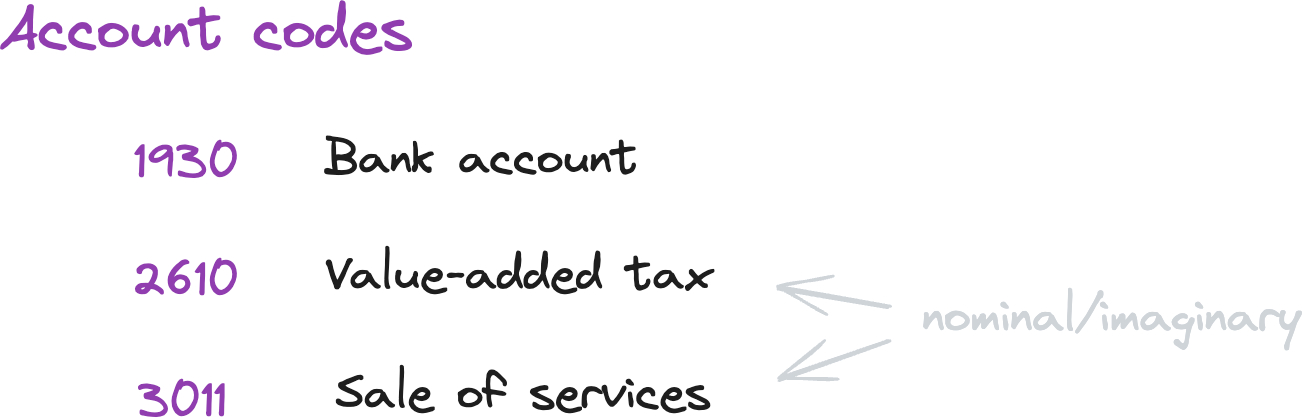

With double-entry bookkeeping, entries also contain information about how the amounts move between different accounts. Most of these accounts aren’t “real” ones, like your bank account, but nominal/imaginary ones, invented for categorization’s sake. For instance, one account might denote how much you’ve sold for. Another might denote how much VAT you owe the tax agency. You assign each account an account code, typically a 4-digit identifier.

An account you subtract money from is said to be credited. Conversely, an account you add to is debited. If you invoice a customer 100,000, you credit 100,000 to the account that denotes what you’ve sold for. At the same time, you debit 100,000 to the account that denotes what you have in your actual bank account.

A real example is slightly more complicated. If 25% VAT, typical in Sweden, is factored in, it’s three separate “sub-transactions” rather than two: debit 100,000, credit 80,000, and credit 20,000. What’s imperative is that the totals of the debits and credits balance for each entry in your ledger.

As a layman, double-entry bookkeeping confused me at first. After a while, I realized what it was all about: it allows entries that are more expressive/granular than compared to my initial naive example. In many cases, an entry deals with more than two accounts. Double-entry bookkeeping keeps the “sub-transactions” grouped and ensures they balance. And because you have all these nominal accounts, you can immediately tell at any given point how much you’ve sold for or loaned and how much VAT you need to pay, even though you don’t have actual bank accounts for them.

What problems do accounting firms and software solutions solve?

In a nutshell, they help you manage your ledger and recurrent administrative tasks. These tasks often involve submitting reports that derive data from your ledger. For instance, both VAT and corporate tax are examples of calculated values.

As most transactions involve an invoice or a receipt, such documents are typically the “triggers” of creating an entry. If you’re using an accounting firm, you might email them documents or drag and drop them to their cloud drive.

In a software solution, for each uploaded document, you usually go through a user interface asking you to describe it. Did you buy a good or a service? Was it a domestic purchase? Was it inside or outside the EU? The solution will try to determine amounts and dates automatically, but it’s not foolproof.

While accounting firms use software solutions themselves, by using one, you get a smoother user experience. The “interface” is much smaller: you don’t have to learn the user interface of the underlying software solution, and you won’t have to figure out any ambiguities or deal with bugs and edge cases.

BAS-kontoplan and SIE

In Sweden, companies overwhelmingly follow a standard called BAS-kontoplan. In essence, BAS-kontoplan standardizes account codes – for instance, you’d use 1930 to denote what you have in your corporate bank account and 1630 for what you have in your tax account. By following BAS-kontoplan, ledgers are more portable, and you’ll also have access to generic tools that generate the required reports. To make these things possible, a non-profit organization has created a file format called SIE (Standard Import och Export).